Results From Blog

OpenViz

OpenViz

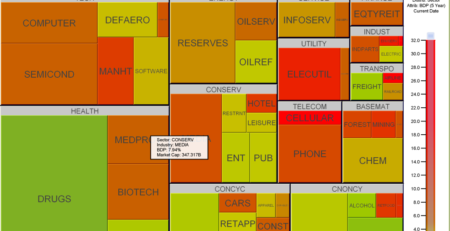

OpenViz Uplifts the Financial Sector

OpenViz is a comprehensive system for visualizing all types of corporate content as fully interactive...

OpenViz

OpenViz

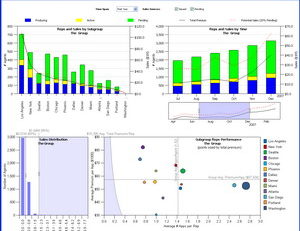

Business Intelligence Made Accessible with OpenViz

Managing thousands of independent brokers at a top-10 insurance group is a formidable task. But...